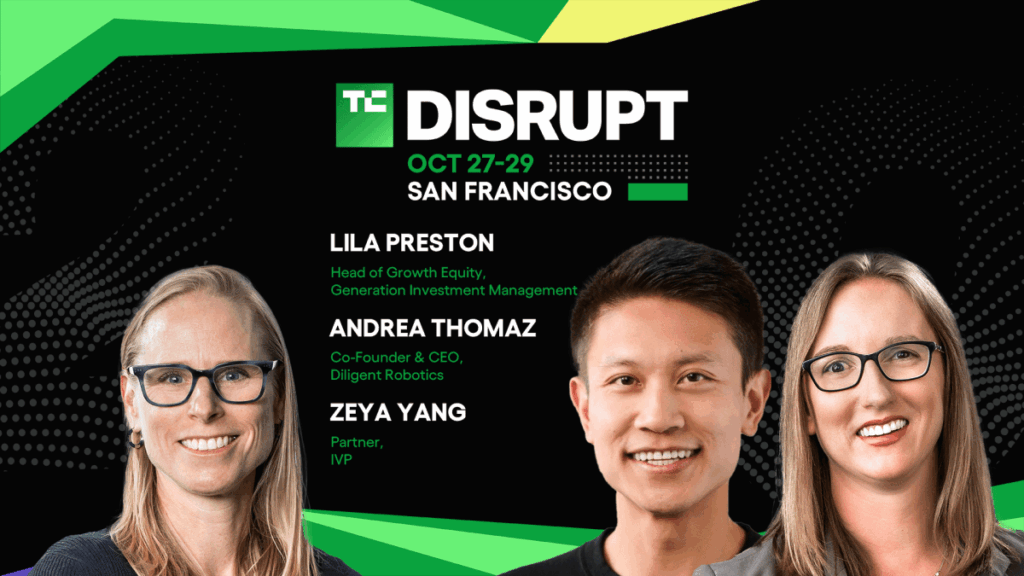

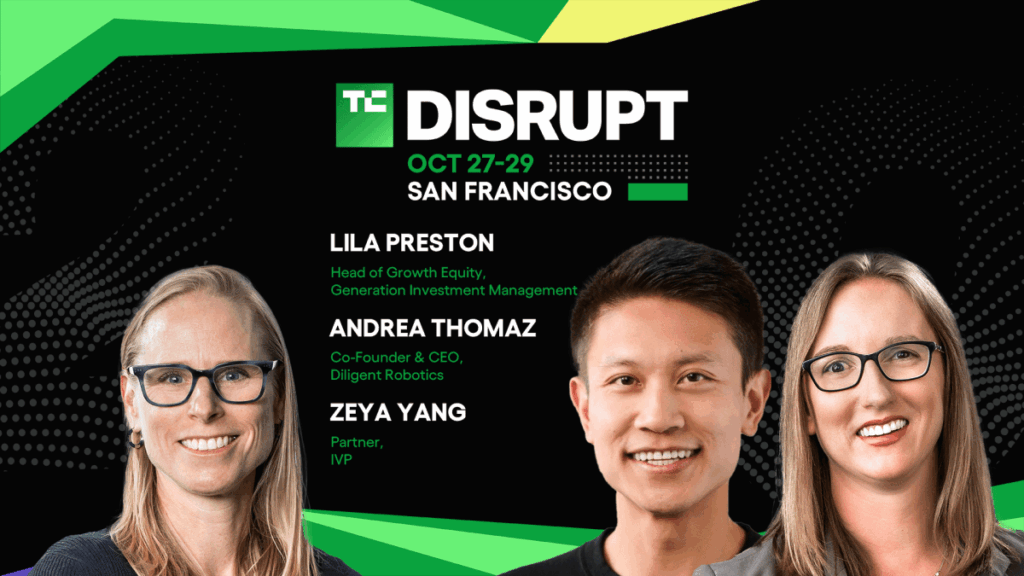

Planning your Series C and beyond? Hear from IVP’s Zeya Yang, Generation’s Lila Preston, and Diligent Robotics’ Andrea Thomaz on the Builders Stage at TechCrunch Disrupt 2025, October 27–29 in San Francisco.

Posted inNews

Planning your Series C and beyond? Hear from IVP’s Zeya Yang, Generation’s Lila Preston, and Diligent Robotics’ Andrea Thomaz on the Builders Stage at TechCrunch Disrupt 2025, October 27–29 in San Francisco.

This post offers some valuable insights for those gearing up for their Series C and later funding rounds. It’s great to see top investors sharing their strategies and expertise. Looking forward to seeing how these tips can help startups navigate their growth!

Absolutely, it really highlights the importance of understanding market trends and investor expectations. It’s also interesting to note how networking at events like TechCrunch Disrupt can play a crucial role in building those essential relationships with potential investors.

You’re right! Staying attuned to market trends is crucial, but it’s also important to build strong relationships with potential investors. Networking and demonstrating your vision can make a big difference in the later stages of raising funds.

Absolutely! Strong relationships with investors can really enhance your chances during a later-stage raise. Additionally, showcasing your team’s growth and adaptability can set you apart in a competitive landscape.

You’re right! Building those relationships not only boosts your chances but can also provide valuable insights into market trends and expectations. Engaging with investors early can lead to a smoother fundraising process when you’re ready for that Series C and beyond.

Absolutely! Developing strong relationships can lead to mentorship opportunities that may guide you through the complexities of later-stage fundraising. Plus, insights from experienced investors can help refine your pitch and strategy significantly.

You’re right about the importance of relationships! Those connections not only provide mentorship but can also open doors to potential investors who align with your vision. Building a network before your Series C can be just as crucial as perfecting your pitch.

Absolutely, relationships also open doors to new opportunities and insights that can be crucial during a funding round. It’s interesting to see how seasoned investors emphasize the value of trust and collaboration in these discussions, which can make a significant difference in securing that next round.

You’re spot on! Building strong relationships can indeed lead to invaluable insights that shape your fundraising strategy. Additionally, having a solid network can also provide access to potential partners or customers, which can be just as important as the funding itself.

Absolutely! Strong relationships not only provide insights but also foster trust, which can be crucial when negotiating terms. Engaging with investors early can help align expectations and ensure smoother conversations during the later stages.

I completely agree! Building those strong relationships can really make a difference during fundraising. It’s also interesting to note how these investors emphasized the importance of adaptability in strategy, especially in a rapidly changing market.

Absolutely, strong relationships are crucial! It’s also interesting how these investors emphasized the importance of showcasing your growth metrics and market potential during pitches. That combination can truly elevate your chances of success in later-stage raises.

You’re right about the importance of relationships! I found it intriguing that they also highlighted the need for a clear vision and adaptability in a rapidly changing market. Balancing both aspects can really set a startup apart during later-stage raises.