The memory supply crisis rages on, sparked by AI datacentres’ ravenous hunger for RAM and system storage. If you’ve been on the hunt for a reasonably priced bit of kit, the most sensible deals have long since been flushed away, with manufacturers also having to grapple with rising costs from their suppliers. But it turns out there’s an unlikely ‘beneficiary’ of the AI industry’s boom years.

Namely, Toto, a massive Japanese company that manufactures bathroom appliances. This week, investment management company Palliser Capital has taken a huge stake in the company, describing it as “The Most Undervalued and Overlooked AI Memory Beneficiary” in a recent presentation (via The Register).

But what does this porcelain god have to do with the AI industry?

Well, for a start, Toto’s advanced ceramic segment is making bucketloads of cash—to the tune of contributing more than 50% of total operating profit. This segment of the business has allowed Toto to become “the dominant supplier of electrostatic chucks for Lam Research’s cryogenic dielectric etching tools used in 3D NAND channel hole etching.”

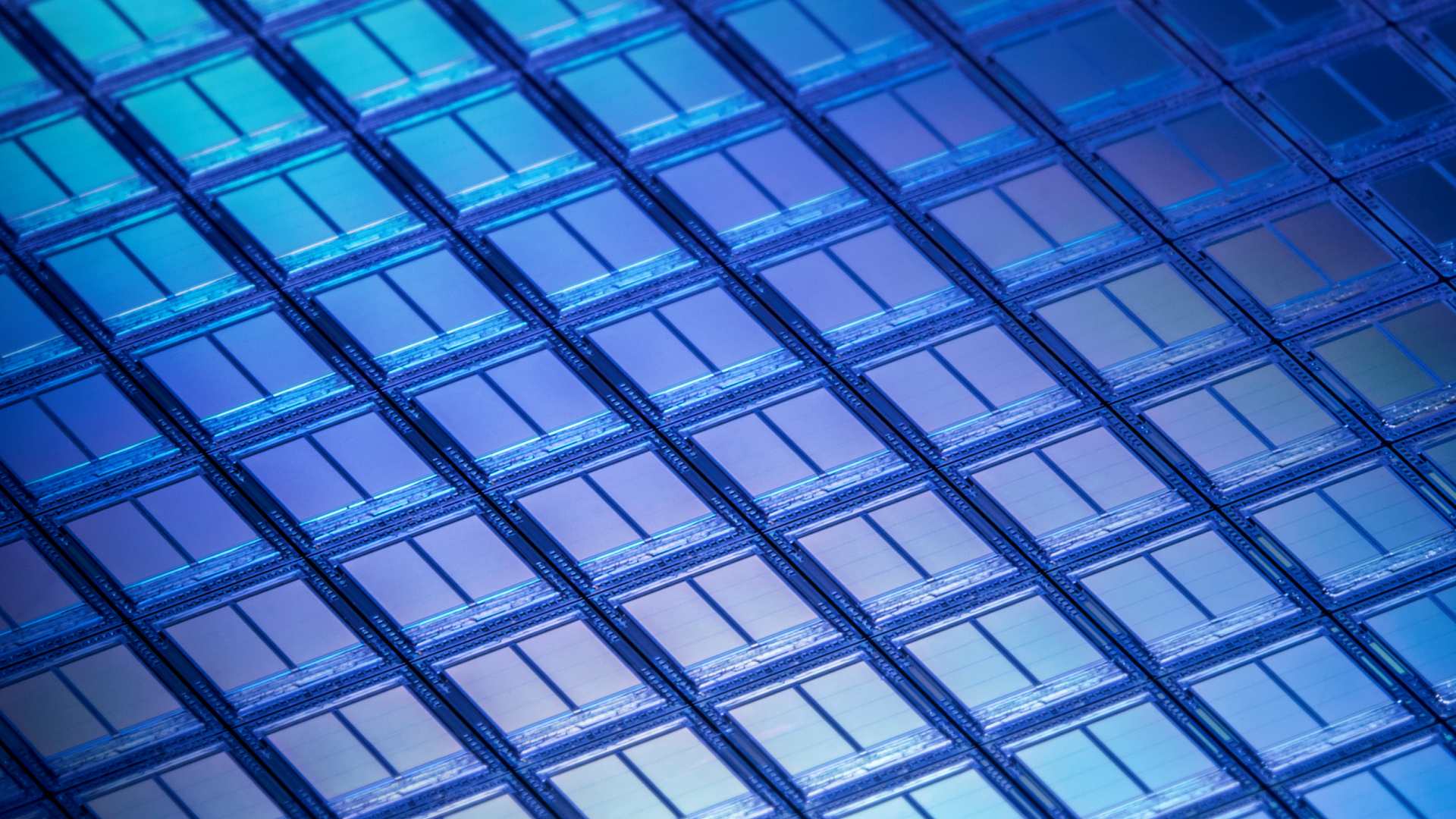

These ceramic chucks can hold many layers of silicon wafer in place securely throughout the extremely low-temperatures required by the etching process.

Palliser Capital, therefore, argues Toto will be a major player when it comes to the production of next-gen chips, and has become one of the company’s top 20 investors. You heard it here first: the future of AI investment is in the toilet.

My indulgent punning aside, a frankly eye-watering amount of money is still being thrown around in big tech’s AI money fight. For instance, just this year Meta, OpenAI, Nvidia, Microsoft, and Amazon have all been linked to investments totalling $200 billion. As such, it’s perhaps unsurprising that investors would be looking for a slice of that pie in the most unlikely of places.

But enough about the deep-pocketed investor—AI’s feeding frenzy has also created a fine mess for consumers. The aforementioned memory supply shortage most recently has seen Phison’s CEO predicting that many consumer electronics manufacturers “will go bankrupt or exit product lines” by the end of this year alone.

In a story close to my filthy console-gaming heart, Sony may even be thinking about pushing the launch of its next-gen PlayStation as far back as 2029.

Nvidia’s $100 billion OpenAI investment plans have apparently ‘stalled’, but it’s hard to say what this means for the future. In the short term, DRAM prices may be plateauing or even beginning to fall, though I doubt we’ll be washing our hands of the AI industry any time soon.