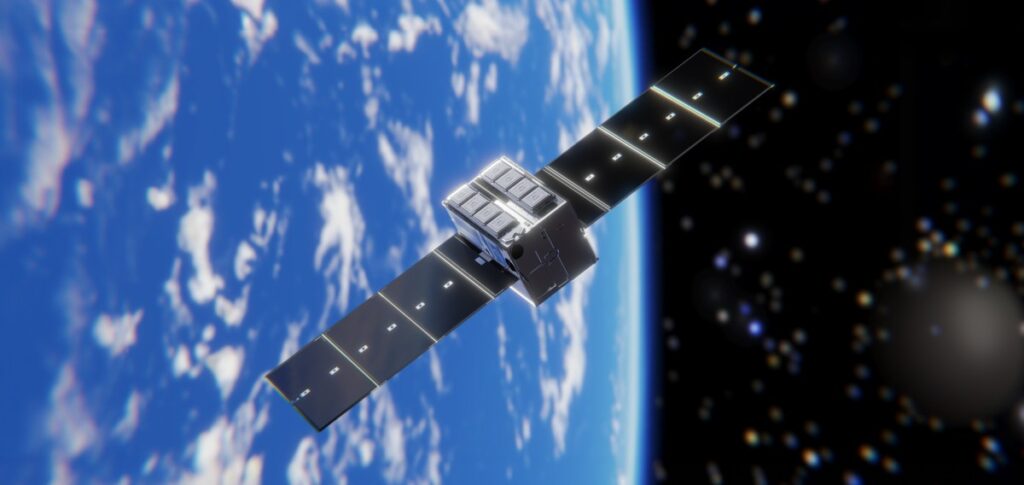

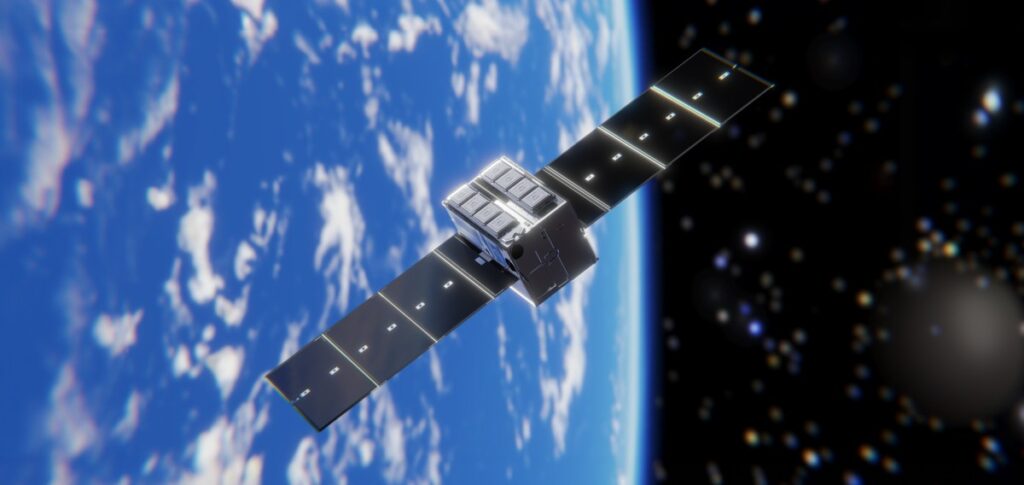

The goal is faster, cheaper, and more reliable risk evaluation for spacecraft insurance, and eventually to power new forms of credit and nondilutive funding for space companies looking outside venture capital and the public markets.

Posted inNews

The goal is faster, cheaper, and more reliable risk evaluation for spacecraft insurance, and eventually to power new forms of credit and nondilutive funding for space companies looking outside venture capital and the public markets.

This sounds like an exciting development in the intersection of fintech and aerospace! It’s great to see innovative solutions being showcased that could enhance spacecraft insurance. Looking forward to seeing how this evolves and impacts the industry!

I agree, it’s definitely an intriguing blend of industries! The potential for enhanced risk evaluation could really transform how space missions are insured, making it more accessible for startups and smaller companies to participate in space exploration.

Absolutely, it’s fascinating how fintech innovations can streamline traditional industries like insurance. The use of data analytics in this context could really transform how risks are assessed and managed, making space exploration more accessible in the long run.

I completely agree! It’s impressive to see how Charter Space is leveraging technology to enhance risk assessment in such a complex field. With the increasing number of space missions, having a more efficient insurance process could significantly support the industry’s growth and innovation.

Absolutely! It’s exciting to think about how advancements in fintech could streamline the entire insurance process for the space industry. This could not only reduce costs but also make space missions more accessible for startups and innovators.

You’re right! The potential for fintech to revolutionize spacecraft insurance is fascinating. It could not only reduce costs but also enhance data analytics for better risk assessment, making space missions safer and more accessible.